On the heels of a rash of pretty good news related to residential real estate—including yesterday's pending home sales report—the June S&P/Case-Shiller report on housing prices checks in with positive monthly gains across all markets in its 20-city composite for the second month in a row. What's more, the index posted its first year-over-year gain since last summer.

The early reviews found little to dislike, from Calculated Risk...

This was better than the consensus forecast and the change to a year-over-year increase is significant.

...to Carpe Diem...

More evidence that the U.S. housing market has passed the bottom and is now in a period of sustainable recovery.

...to TimeBusiness...

[T]he housing market is steadily improving and is poised to contribute to economic growth this year. Modest economic growth and job gains are encouraging more Americans to buy homes.

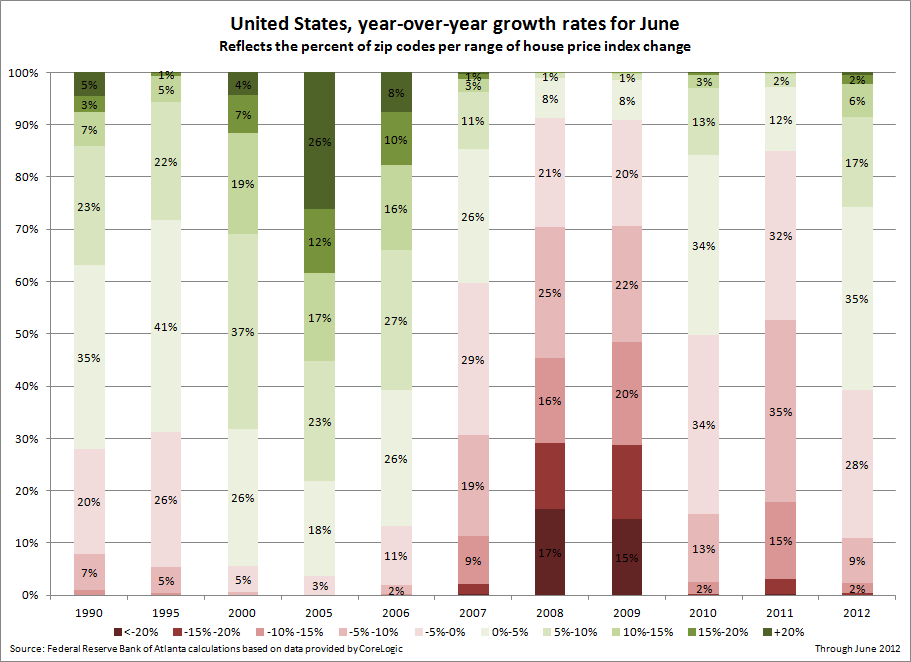

The widespread nature of price firming evident in the Case-Shiller index is strikingly confirmed by looking at even more disaggregated data. The following chart shows June year-over-year price growth by zip code, before the crisis hit and since, based on data available from CoreLogic:

The sample represented by the chart covers about 21 percent of all of the zip codes in the nation, and is based (like Case-Shiller) on a repeat-sales methodology.

The striking aspect, of course, is that there haven't been price increases in the majority of the sample's zip codes since before 2007 (although there was improvement evident in 2010, followed by the re-emergence of broader weakness in 2011). Furthermore, the uniformity of the picture becomes even more apparent when you look market by market (across which the experience is not so uniform). Two of the big comeback stories—Miami and Phoenix—were uniform in the breadth of the suffering across their metro areas during the worst of the slump and are now just as uniform in recovery:

Folks in Atlanta, on the other hand—which remains the big negative outlier in the year-over-year Case-Shiller statistics—are just as uniform as Miami and Phoenix, but in the pain rather gain department:

Even so, the Atlanta market has had two consecutive months of Case-Shiller housing price appreciation and experienced the largest monthly percentage gains in the June report. It does appear that the rising residential real estate tide is raising most boats.

By Dave Altig, executive vice president and research director;

By Dave Altig, executive vice president and research director;

Myriam Quispe-Agnoli, research economist and assistant policy adviser; and

Myriam Quispe-Agnoli, research economist and assistant policy adviser; and

Jessica Dill, senior economic research analyst, and all with the Atlanta Fed

Jessica Dill, senior economic research analyst, and all with the Atlanta Fed